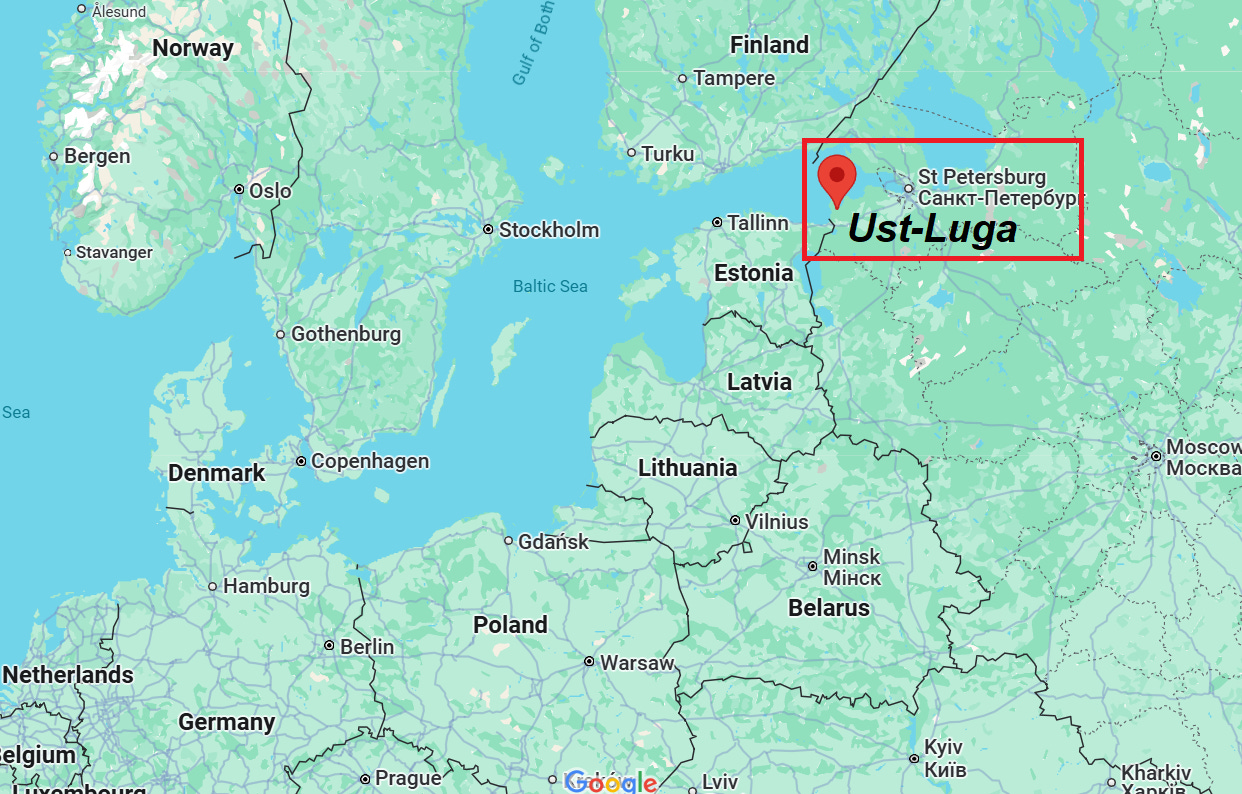

On January 22, 2024, nearly a year ago, Ukraine launched an attack on the Russian gas terminal at Ust-Luga, Russia's second-largest seaport. Following this strike, Ukraine steadily escalated its drone campaign, targeting Russian oil refineries with increasing intensity while focusing on export terminals and storage facilities. This offensive, which ramped up through March, culminated in mid-April 2024.

By then, Ukraine had incapacitated nearly 17% of Russia’s refining capacity. In total, 18 oil refineries, with a combined production capacity of 3.9 million barrels per day, were hit.

J.P. Morgan reported that “670,000 barrels per day of Russian refining capacity is currently offline due to the strikes.” The attacks were so devastating that panic reverberated not only within Russia but also in Washington, D.C. The campaign ended after U.S. Secretary of Defense Lloyd Austin publicly urged Ukraine to prioritize military targets over Russian refineries.

Reluctantly, Ukraine eased off its campaign. Between May and December 2024, Ukraine barely targeted Russian refineries. There were isolated strikes on Russia’s seaport in Novorossiysk, but even those were arguably not attacks on Russia’s broader economic machinery, given that Novorossiysk also hosts the Black Sea Fleet.

Ukraine continued to regularly target the Novoshakhtinsk oil refinery in the Rostov region, the closest facility to the war zone. However, this refinery is better classified as a military target due to its proximity—less than 200 kilometers from the frontline—and its critical role as an immediate supplier of oil for Russia’s war machine.

For most of 2024, Ukraine largely refrained from attacking Russia’s export terminals and refineries. That restraint ended on January 4, 2025, when Ukrainian drones struck the Novatek gas terminal in Ust-Luga.

As usual, Russia claimed that all the drones launched by Ukraine were neutralized. And as usual, video and photographic evidence proved otherwise.

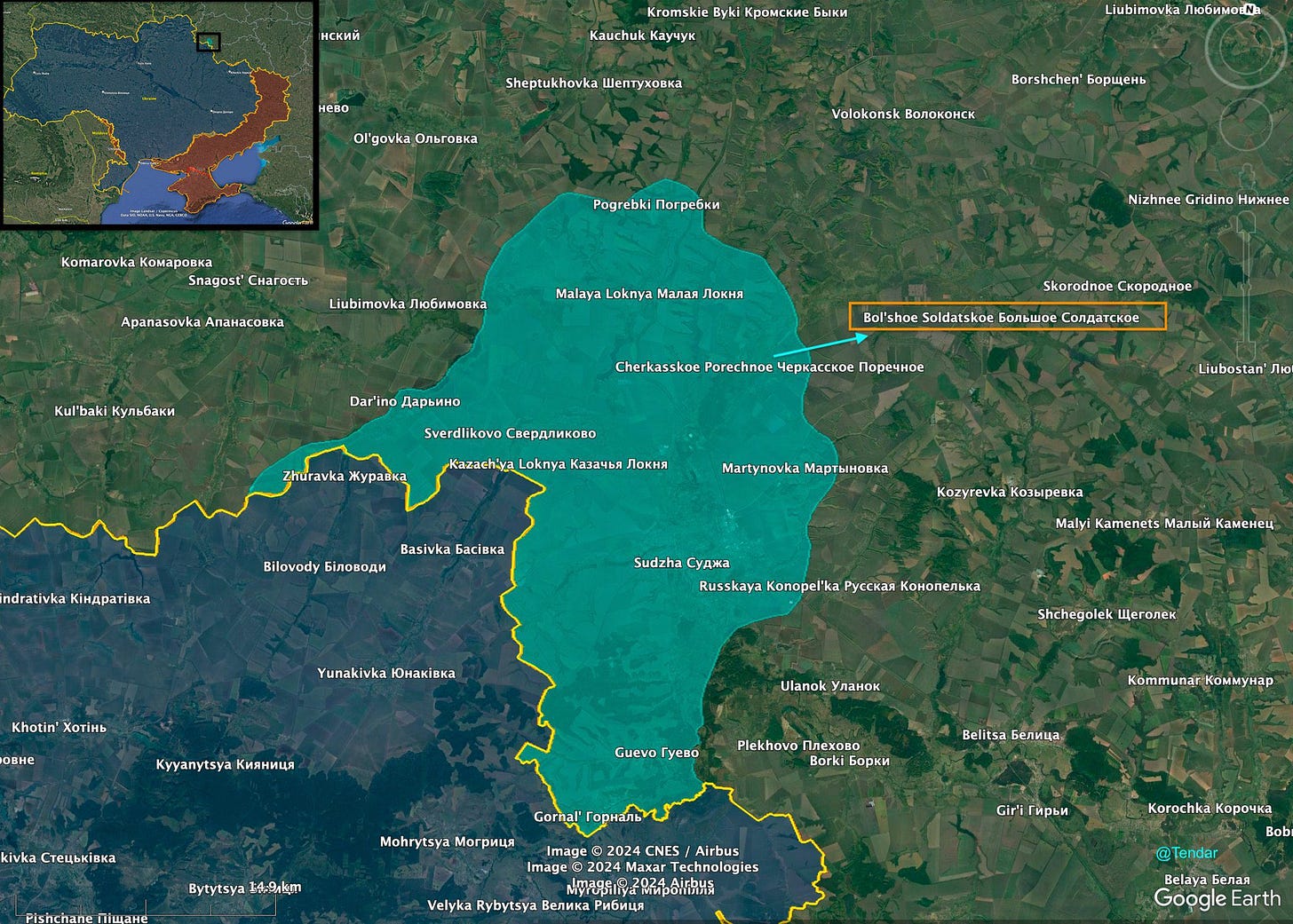

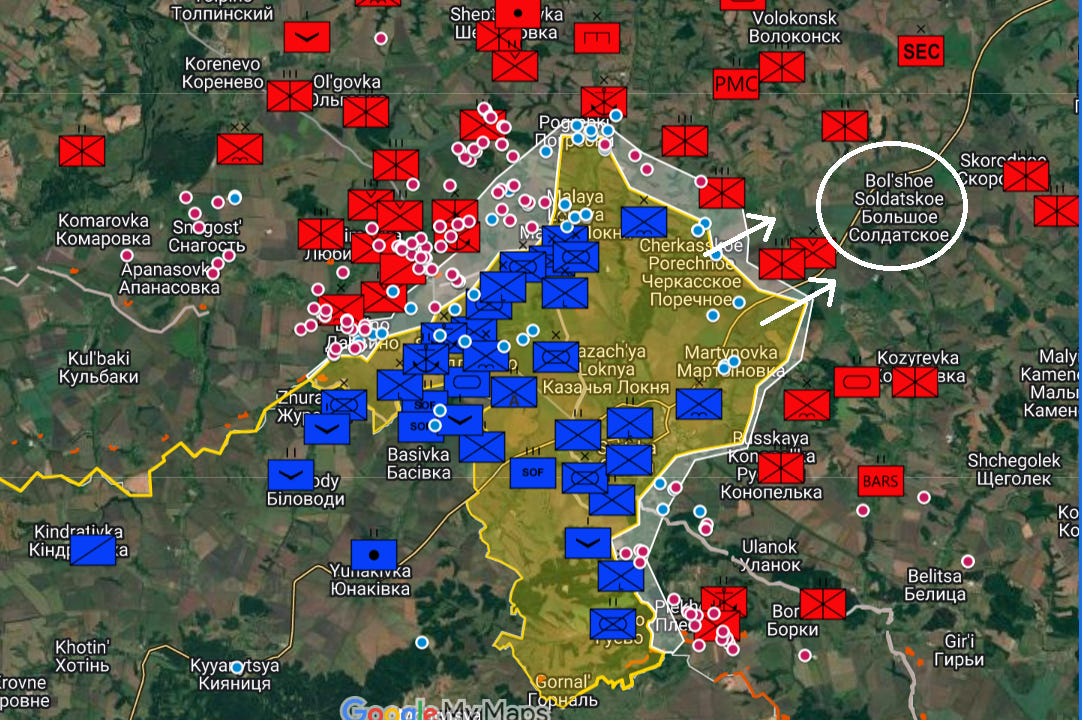

I wasn’t ready to call the attack a shift in strategy—one strike doesn’t make a pattern. But today, Ukraine launched a counter-attack in Kursk Oblast, catching the Russians off guard. Military bloggers from both sides reported that Ukraine advanced toward the Russian town of Bolshoye Soldatskoye.

The positional map below illustrates that the frontline in Kursk is firmly established, with both sides engaged in combat in the region for over three months. Advancing toward Bolshoye Soldatskoye is a complex and challenging decision, given the heavy concentration of Russian forces in the area.

As has been the case with Ukrainians since the beginning of the war, when you expect them to do one thing, they end up doing something entirely different. Just yesterday, I suggested that Ukraine might push toward the left and top of the map in Kursk Oblast. Instead, they advanced to the right. The current attack toward Bolshoye Soldatskoye might be an elaborate feint, but if the Russian lines break, why not press the advantage?

The Russians, focused on driving Ukrainian forces out of Kursk, did not construct elaborate fortifications or continuous defensive lines in this region. These are open lands where both sides rely on mobile formations for attack and defense, making breakthroughs less difficult compared to the heavily fortified Southern Ukraine.

Compounding Russia’s challenges, there is ample open territory near the Ukrainian border where Ukraine can maneuver if it chooses. What remains to be seen is how Ukraine plans to capitalize on this situation.

Now, to address the pundits who argue that Ukraine is wasting time and resources in Kursk: this perspective is fundamentally flawed. Approximately 50,000 Russian troops are currently engaged in combat in Kursk. Without this Ukr incursion, those Russian forces would be inside Ukraine, ravaging its territory and conducting airstrikes on Ukrainian homes. Instead, these troops are now fighting on Russian soil, dropping bombs on their own land.

Ukraine has effectively shifted the battlefield, holding roughly 600 square kilometers of Russian territory. If Ukraine further expands this footprint by adding another 1,000 square kilometers, that land could become a valuable bargaining chip for future territorial exchanges.

In the broader context, Ukraine has two options to reclaim its occupied territories: directly expel Russian forces or seize Russian land to use as leverage. Just as the Russians do, demand the maximum in return—10 square kilometers of Ukrainian land for every 1 square kilometer held. For example, 2,000 square kilometers of Kursk could be exchanged for 20,000 square kilometers of Southern Ukraine.

Every option that strengthens Ukraine’s negotiating position must be pursued. Every kilometer of Russian land under Ukrainian control will become immensely valuable in the final stages of this conflict.

Russia probably has two options 1) move troops from Ukraine as rapidly as possible (slow given outer lines and poor logistics s) to reinforce Kursk or 2) leave troops in Ukraine and hope for the best.

The dilemma is if they do 1) they will open up an opportunity for Ukraine to breach their lines in the Ukraine and if they do 2) Russia creates the opportunity for a breach into the rear echelons within Russia itself.

There are no good choices here for Russia. Hoping the existing troops can hold in Kursk isn’t…a strategy.

My thinking on the value of Kursk matches yours. I've found most of the negative commentary on Ukraine's offensive comes from the corporate media world, and I dont believe in their military expertise, because they have none.